The Ontario government is regularly releasing reports on the insights gained by the OCS - however, for those entrenched in the fast-paced environment that is cannabis retail, reading and understanding a 27-page report full of dense data & learnings may fall to the bottom of their to-do list. For this reason, the grnhouse team has broken down our top 4 learnings from the latest Insight Report.

More Ontarians Are Buying Legal Than Ever

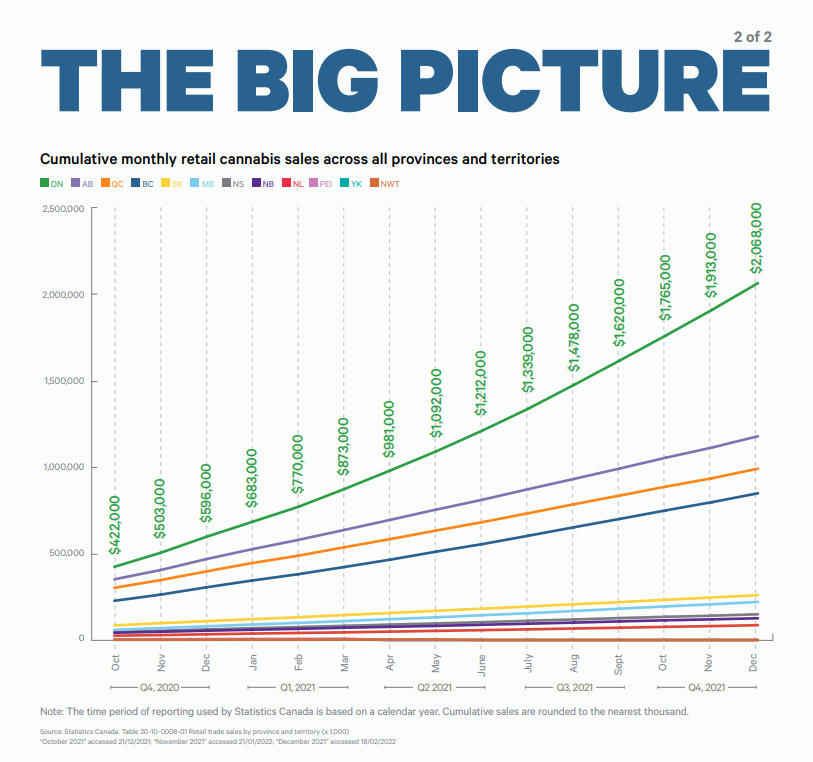

With more brands and retailers than ever, there seems to be no reason not to shop legal; and the data OCS released seems to reflect this. On the first page of OCS’s report, they’ve documented the rise of legal cannabis across the province. Growing a little over 4% since Q2, now 58.8% of Ontario cannabis consumers have decided to buy their cannabis from legal sources - perhaps due to the convenience that comes from 1,333 retail stores now operating in the province. This is further illustrated by a graph on page 6, where OCS shows the Cumulative monthly retail cannabis sales across the country. Represented by green, Ontario’s sales far surpass every other province or territory, growing from $422,000 in Q4 of 2020 to $2,068,000 by the end of Q4, 2021.

Dried Flower Is Still King Of The Categories

As a surprise to no one, Dried Flower is still the number one product category across Ontario. While the segment saw a slight fall since Q2, 2021, it still makes up for 49% of sales across Ontario. What brands are dominating the category? With the majority of sales for Dried Flower falling between $3-6.50 per gram, it’s no surprise that PureSun Farms is the highest-selling flower brand across both retail stores and OCS.ca with SHRED close behind for retailers and Redecan for OCS.ca orders.

More Consumers Are Going To Stores Than Ever Before

According to OCS’ report, 68% of OCS.ca shoppers have visited a retail store within the last 3 months. This is a 3% rise compared to Q2 of 2021. While sales have grown across the province as a whole as more consumers visit legal retailers, sales have steadily fallen for individual retailers as more competition has been created with the boom in retail licenses being granted; the average sales for retailers have steadily fallen since Q3, 2020, to less than 50% of what they used to be.

Where Do Consumers Learn?

Cannabis marketers are always curious as to where consumers are doing their research, which thankfully, the OCS has broken down for better understanding. The vast majority of research(58%) is done directly on ocs.ca, while “Cannabis Review Websites” holds #2 with 43% - although OCS failed to elaborate on which websites. The third, and most susceptible to outside influence, was “Family/Friends” with 38% of consumers citing the opinions of those close to them as a deciding factor on what they consume.

Tied for fifth place at 32% is Social Media(with Reddit used as the example) and Budtenders - demonstrating that while budtenders have a heavy influence on consumer habits, however, the opinions of the masses seem to be rising above expert opinions.

If you’re interested in reading OCS’ Insight Report, it can be found alongside previous reports on their website.